1.Executive Summary

The global laser welding machine market experienced significant growth in 2024, reaching a valuation of USD 2.7 billion. With fiber laser technology driving higher efficiency, precision, and economic benefits, the market is projected to expand to USD 2.9 billion in 2025 and reach USD 4.5 billion by 2034, at a CAGR of 5.2%. Handheld laser welders, along with multi-functional and automated systems, are gaining popularity across industries such as automotive, aerospace, electronics, and renewable energy. This analysis provides updated cost details for various machine types—including handheld, CNC, robotic, and combination units—and highlights emerging technological and competitive trends.

2.2025 Price Breakdown by Machine Type

| Power |

Price Range (USD) |

Details |

| <1000W |

5,000–5,000–10,000 |

Entry-level (e.g., JPT M7, IPG LightWELD) |

| 1000W–1500W |

12,000–12,000–20,000 |

Mid-range with enhanced portability |

| 1500W–2000W+ |

18,000–18,000–30,000+ |

High-power models (e.g., Bodor 1500 Pro) |

- Notes: Prices below $5,000 may reflect used/refurbished units or limited warranties. Self-cooling systems add ~20% cost.

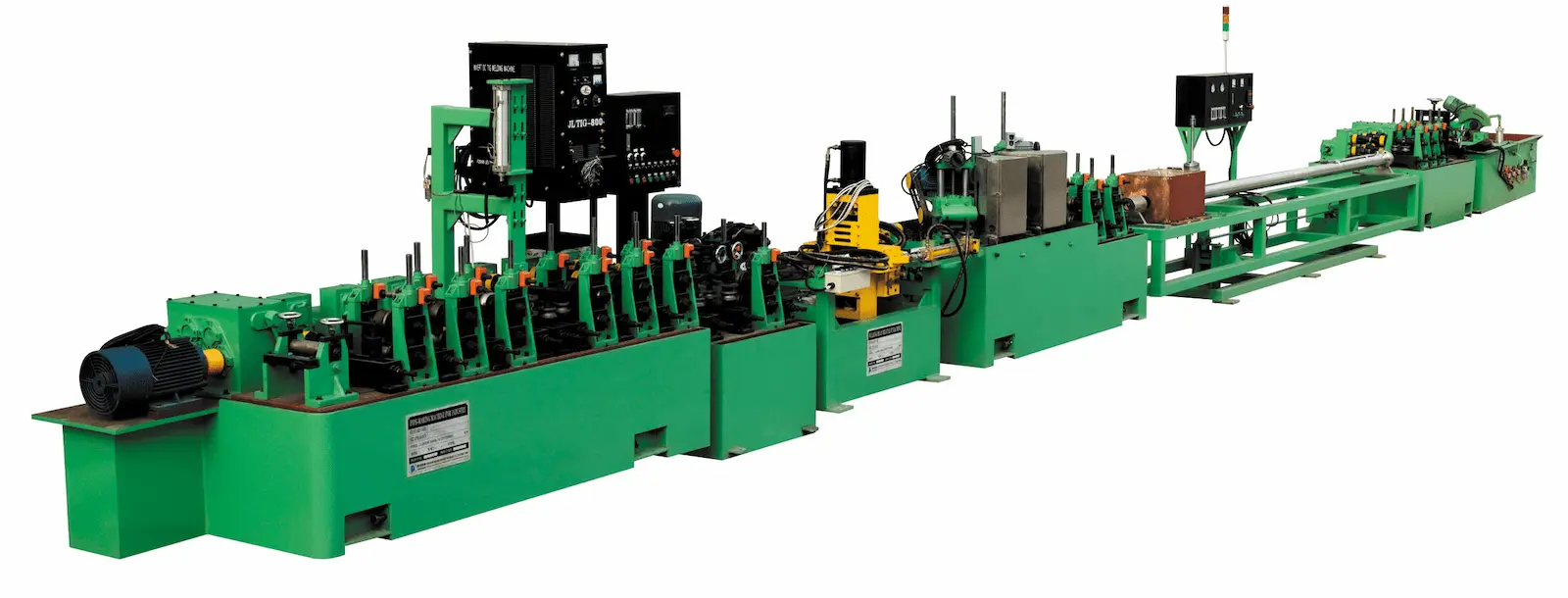

2. CNC Laser Welding Machines

| Power |

Price Range (USD) |

Applications |

| 300W–500W |

50,000–50,000–80,000 |

Precision welding for thin materials |

| 600W–1000W |

80,000–80,000–150,000 |

Automotive/aerospace components |

| 1000W–2000W |

150,000–150,000–400,000+ |

Heavy-duty industrial automation |

- Key Factors: European brands (TRUMPF, Amada) cost 20–30% more than Asian equivalents (HAN’S LASER, MAXphotonics).

3. Industrial Robotic Laser Welding Systems

| พลังเลเซอร์ |

Price Range (USD) |

Inclusions |

| 2000W |

150,000–150,000–300,000 |

Basic robot arm + laser source |

| 4000W |

300,000–300,000–500,000 |

Custom programming + high-precision arms |

| 6000W |

500,000–500,000–800,000+ |

Full integration with AI quality control |

- Critical Note: Prices exclude 5,000–5,000–30,000 integration costs. KUKA/FANUC systems command a 15–25% premium.

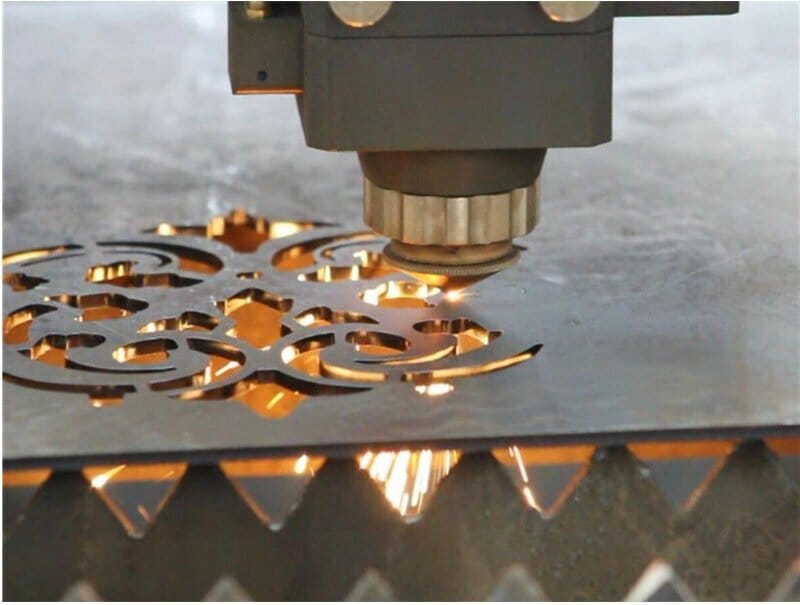

4. Combination Laser Cutter/Welder Machines

| Power |

Price Range (USD) |

Examples |

| 500W–1000W |

80,000–80,000–150,000 |

Small-batch production (e.g., Mazak) |

| 1000W–2000W |

150,000–150,000–400,000 |

Multi-functional industrial use |

| >2000W |

400,000–400,000–800,000+ |

High-throughput systems (e.g., TruLaser) |

- Cost Drivers: Integrated cutting/welding software adds 10,000–10,000–50,000.

Revised Cost Influencers (2025)

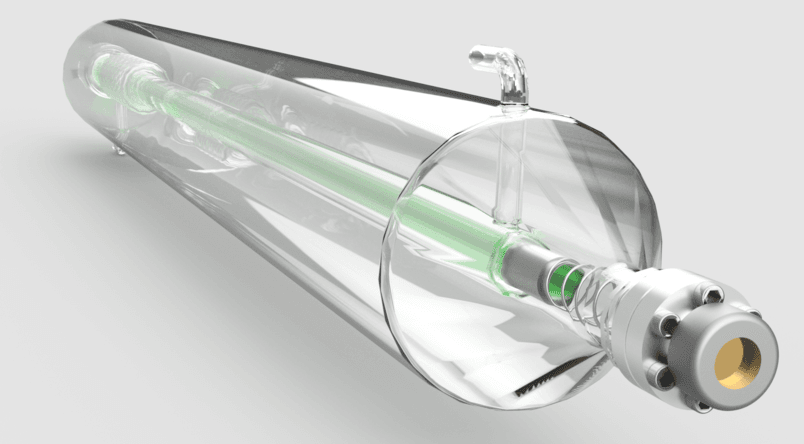

- Laser Type: Fiber lasers cost 10–15% more than CO₂ but save 30% energy.

- Automation: AI-driven defect detection increases prices by 10,000–10,000–50,000.

- Regional Competition: Chinese brands (Bodor, HYGN) undercut Western prices by 15–20%.

- Sustainability: Energy-efficient models have 20–30% upfront premiums but reduce long-term costs.

Market-Aligned Trends

- Fiber Laser Dominance: 70% of new installations expected by 2025.

- Handheld Demand: Portable welders grow at 8% CAGR, driven by repair and small-scale manufacturing.

- AI Integration: 40% of industrial systems include real-time monitoring by 2025.

- Price Erosion: Asian manufacturers reduce mid-tier CNC/robot costs by 10–15% annually.

Strategic Recommendations for Buyers

- Prioritize Total Cost of Ownership (TCO): Include maintenance, energy use, and software updates.

- Verify Specifications: Low-cost CNC/robotic systems may exclude critical components (e.g., cooling, safety features).

- Leverage Regional Pricing: Source handheld/CNC units from Asia for cost savings; opt for EU/US brands for heavy automation.

- Future-Proofing: Invest in modular systems compatible with AI and green tech upgrades.

Data reflects 2024 market benchmarks and 2025 projections from industry reports (GM Insights, TRUMPF, HAN’S LASER).